Rebalancing is a critical component of maintaining a healthy portfolio. Understanding its mechanics ensures that your investments stay aligned with your goals. Learn how this essential process can optimize your long-term financial growth. Check investment firms which offers access to expert educational resources, connecting traders with professionals who simplify the complexities of portfolio rebalancing.

Asset Allocation: The Building Block of Investment Portfolios

Asset allocation is the foundation of every successful investment strategy. It’s like preparing a recipe—getting the right mix of ingredients is key. In the context of investing, the ingredients are stocks, bonds, cash, and perhaps alternative assets like real estate or commodities. The goal? To create a well-balanced portfolio that aligns with your financial goals and risk appetite.

Think of it this way: if you’re someone who gets anxious when markets fluctuate, you’d likely want a portfolio heavier on bonds, which are more stable. On the other hand, if you’re comfortable taking more risks in hopes of higher rewards, a stock-heavy allocation may make more sense. Imagine you’re cooking for a group of picky eaters—each person’s plate needs to be customized based on what they can handle. That’s asset allocation in a nutshell.

The way you allocate assets isn’t a one-size-fits-all approach. It depends on factors like age, financial goals, and how long you plan to keep your investments. A younger investor may take on more risk by favoring stocks, while someone nearing retirement might lean toward bonds. However, even the perfect allocation isn’t set in stone. It needs to be revisited as life circumstances and financial markets change. It’s like adjusting the ingredients in a recipe over time as tastes and dietary needs evolve. Would you serve the same meal every day for 30 years? Probably not—and the same logic applies to your portfolio.

The Drift: How Market Movements Disrupt Asset Allocations

Markets are unpredictable, and that’s where things can get tricky. Over time, your portfolio may start to “drift” away from its original allocation due to market fluctuations. For example, let’s say you initially wanted 60% in stocks and 40% in bonds. If the stock market surges, you might suddenly find your portfolio looking more like 70% stocks and 30% bonds. This might sound like a good problem to have, but it can expose you to more risk than you initially planned for.

This drift happens because asset classes don’t all move in tandem. Stocks could skyrocket, while bonds barely budge. Over time, your carefully planned allocation gets out of sync. It’s like ordering a balanced meal and suddenly realizing all you have left is dessert. Not exactly what you intended, right?

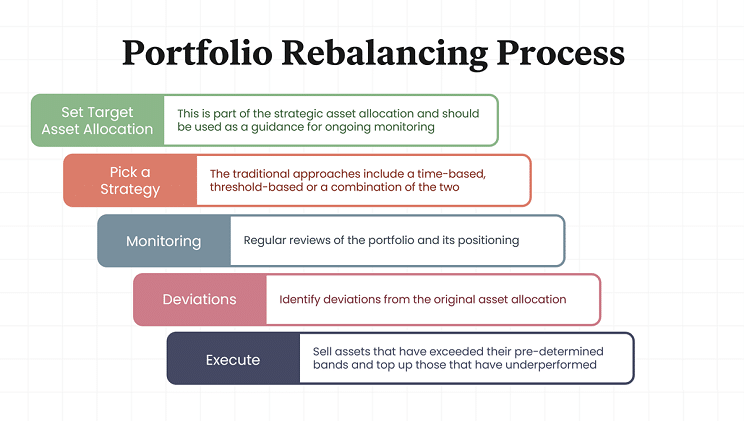

Rebalancing helps correct this drift by selling off some of the overperforming assets and reinvesting in those that have underperformed. It’s not about chasing returns—it’s about maintaining balance. This way, you’re not letting one part of your portfolio take over the show. Some investors might feel tempted to let their high-performing assets ride, but doing so can add unnecessary risk. Remember, what goes up often comes down. So, it’s worth asking: Are you comfortable with where your portfolio is now, or is it time to check how far it has drifted?

Risk vs. Reward: The Delicate Balance

Risk and reward go hand in hand, and balancing them is a constant juggling act. Imagine walking a tightrope—you don’t want to lean too far in either direction, or you risk falling off. The same goes for investing. Take on too much risk, and you might be setting yourself up for big losses. Play it too safe, and you may miss out on the growth needed to meet your financial goals.

In investing, risk is often associated with the potential for loss, while reward refers to the potential for returns. If you’re aiming for higher returns, you’ll need to be okay with a higher degree of risk. But this isn’t just about numbers—it’s also about your personal comfort level. How well do you sleep at night when the markets are volatile? That’s a good indicator of whether you’re taking on too much or too little risk.

Balancing risk and reward involves constant re-evaluation. The market doesn’t care about your comfort zone, so it’s important to stay vigilant. By regularly checking your portfolio, you can decide if your current balance still makes sense. A well-balanced portfolio can offer the growth you need while keeping your risks manageable. But remember: the perfect balance is different for everyone. What’s important is figuring out where your sweet spot lies and making adjustments as needed. Do you feel confident about your current balance, or does it feel a bit too risky for comfort?

Conclusion

Mastering the art of portfolio rebalancing is crucial for long-term success. Regularly adjusting your investments to match your goals keeps you on track and protects your portfolio from unnecessary risk.