Stock splits and reverse stock splits are powerful financial maneuvers that can reshape a company’s stock value without altering its market cap. Understanding how these splits work helps investors anticipate market shifts and evaluate long-term stock potential. Curious about how stock splits affect your portfolio? Zentrix Ai provides a bridge to specialists who help investors navigate such corporate maneuvers with ease.

Detailed Breakdown of How Stock Splits and Reverse Stock Splits Are Executed?

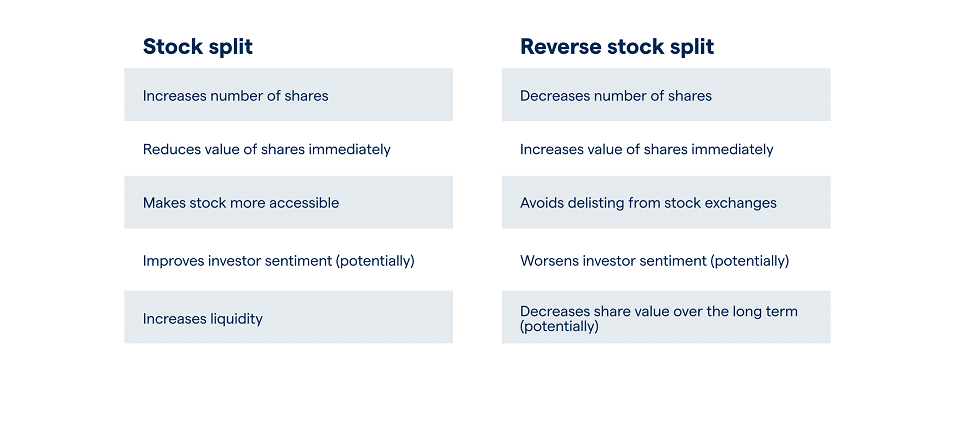

Stock splits and reverse stock splits may seem like technical moves, but the process is actually straightforward. In a regular stock split, a company increases the number of its shares by dividing the existing ones. For instance, in a 2-for-1 stock split, every existing share becomes two.

If a person holds 100 shares, they will now own 200 shares, but the value of each share gets halved. The overall value of the investor’s holdings remains the same—it’s like cutting a pie into more slices, but the pie itself doesn’t get bigger. Companies use this method when their stock price becomes too high, making it easier for small investors to buy in.

A reverse stock split works in the opposite way. In this case, the company reduces the number of shares by consolidating them. A 1-for-10 reverse split means an investor who holds 10 shares will now have just 1, but the price per share increases tenfold. Again, the overall value stays the same.

Reverse splits are often used when a company’s share price drops too low, as this can help meet stock exchange requirements or make the stock look more attractive. It’s like trying to boost your confidence by putting on a nicer outfit—it might help, but it doesn’t fix deeper problems.

Impact on the Stock Price and the Number of Outstanding Shares

The most noticeable effect of both stock splits and reverse stock splits is on the stock price. In a regular stock split, the price per share drops, but the total number of shares increases. Imagine holding a large pizza, but it’s cut into more slices. Each slice is smaller, but there are more to go around. As a result, the stock becomes more affordable for potential buyers, which can lead to increased trading activity and possibly drive demand.

In a reverse stock split, the opposite occurs. The number of shares is reduced, which boosts the price of each individual share. However, while the share price goes up, the company’s overall market value doesn’t change.

This can help a company meet certain listing requirements (such as maintaining a minimum stock price), but it doesn’t mean the company’s financial health has improved. In some cases, reverse splits are seen as a red flag by investors, as they can signal deeper financial issues.

It’s also important to note that the impact on the stock price is often psychological. Some investors might be attracted to a stock that appears cheaper after a regular split, while others might be cautious of a company that performs a reverse split. But at the end of the day, the value of their investment hasn’t changed—just the way it’s packaged.

Real-World Examples Demonstrating These Mechanics

Real-world examples help clarify how stock splits and reverse stock splits play out in practice. Take Apple’s famous 4-for-1 stock split in 2020. Apple’s stock price had surged so much that it became expensive for smaller investors.

By splitting the stock, Apple made it more accessible, attracting a broader base of buyers. After the split, demand rose, and the company’s market value continued to grow. It’s a bit like offering smaller portions at a restaurant—you reach more customers who couldn’t afford the large meal.

On the flip side, a well-known reverse stock split example comes from Citigroup in 2011. The bank was hit hard by the 2008 financial crisis, and its stock price fell below $5. To avoid being delisted from the New York Stock Exchange, Citigroup performed a 1-for-10 reverse split.

This helped push the share price up to a more acceptable level, but investors remained cautious. Reverse stock splits don’t fix underlying issues; they just change the appearance of the stock price.

These examples highlight how companies use these tools to manage their stock’s accessibility and perception. Yet, a shiny new coat of paint doesn’t mean the building underneath has been renovated. Investors should always look beyond the split and assess the company’s overall financial health before making decisions.

Conclusion

Whether a stock split increases share count or a reverse split reduces it, both strategies carry significant implications for investor portfolios. Recognizing how they work empowers investors to navigate market dynamics with more confidence.