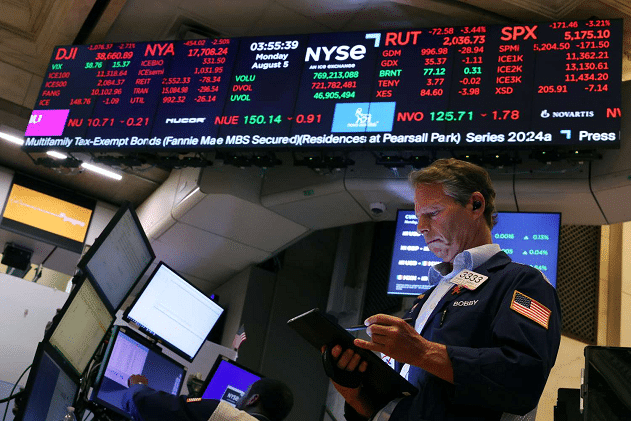

A spike in stock prices can make headlines, but is it a sign of sustained value or just short-term noise? Exploring the balance between short-term gains and long-term growth can reveal whether stocks are truly positioned for future success. What drives stock price reactions—short-term excitement or long-term fundamentals? Wealthicator connects traders with firms offering expert guidance on how to interpret these shifts.

The Immediate Stock Price Impact Following Buyback Announcements

When a company announces a share buyback, it often leads to a short-term boost in its stock price. Investors interpret this as a positive signal that the company believes its stock is undervalued.

This confidence from management usually triggers a buying frenzy, increasing demand for the shares. The stock price rise can range from modest to significant, depending on the size of the buyback and the overall market sentiment.

For example, when Apple initiated its $100 billion buyback in 2018, the stock price jumped immediately. This rapid reaction is typical because investors see buybacks as a reward and expect the reduced share count to improve earnings per share (EPS).

However, it’s important to remember that not all buybacks spark the same level of excitement. The market’s response depends on many factors, including the company’s financial health and its growth prospects.

So, what’s the catch? These spikes, while enticing, often create a temporary euphoria. It’s like finding a $20 bill on the ground—exciting but not life-changing. The key is to understand that the initial boost might not always last.

Why Short-Term Price Increases Do Not Always Translate Into Sustained Value?

While stock buybacks can lead to a quick uptick in price, these gains are not always a sign of long-term value. In fact, they can sometimes mask underlying problems. A buyback might prop up the stock price temporarily, but if the company’s fundamentals aren’t solid, the gains could fade.

One common issue is companies using debt to finance buybacks. While it may push the stock price higher in the short term, taking on too much debt can strain the company’s balance sheet, leading to financial trouble down the road.

An example of this is General Electric, which aggressively bought back shares in the 2010s but later faced financial difficulties due to its increased debt burden.

Another problem is that buybacks can sometimes signal that a company lacks better ways to invest its capital. Instead of funding new projects or innovation, the company might resort to buying back shares just to keep investors happy. But a stock price is like a soufflé—if there’s nothing solid underneath, it will collapse.

Ultimately, while short-term price spikes are exciting, long-term investors need to ask themselves: is this buyback based on confidence, or just a quick fix?

Analysis of Historical Data Showing Market Reactions to Buybacks

Over the years, stock buybacks have shown mixed results in terms of long-term market reactions. Historical data suggests that, while companies often see an immediate rise in their stock price after announcing buybacks, the effect tends to wane over time. In some cases, the buybacks have created sustained value, but in others, they have had little impact beyond the initial spike.

For instance, between 2010 and 2020, S&P 500 companies repurchased more than $5 trillion worth of shares. During this period, there were significant short-term boosts, but studies reveal that companies that aggressively repurchase shares don’t always outperform those that reinvest profits into growth opportunities. The reasoning is simple: not all buybacks are equal.

In many cases, companies that bought back stock at inflated prices saw poor long-term returns, as the stock’s value eventually corrected itself. Conversely, firms that timed their buybacks when the stock was undervalued tended to fare better in the long run.

Think of it like buying shoes on sale—getting a great pair at a discount is always better than overpaying for something that won’t last.

This historical perspective shows that while buybacks might lift the stock price in the short term, only well-timed, strategic buybacks consistently deliver long-term shareholder value.

Conclusion

Short-term stock price movements can be tempting, but the real question lies in long-term value creation. Investors must look beyond temporary spikes to ensure their portfolio stands the test of time.