The Butterfly Spread is a sophisticated options strategy that allows traders to profit from minimal price movement. Understanding its setup provides a valuable tool for risk management. What if you could connect with educational experts through GPT 2.0 Definity to better understand complex strategies like the butterfly spread?

What Are Butterfly Spreads? The Basics Explained

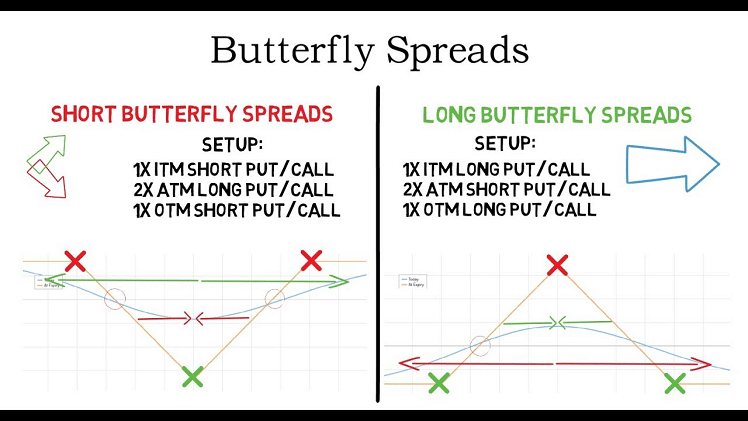

A butterfly spread is a widely-used options strategy. It involves three different strike prices and multiple options contracts, all set to expire at the same time. This strategy is often seen as a low-risk, low-cost way to navigate uncertain markets. The basic structure includes buying two options—one with a higher strike price and one with a lower one.

Then, you sell two options at a strike price in the middle. Picture this like the wings and body of a butterfly—two “wings” with the higher and lower strike prices, and a “body” at the middle strike price.

This structure is symmetrical, meaning it creates a profit zone when the price of the underlying asset stays close to the middle strike price by expiration. The potential profit is limited to the difference between the strike prices minus the initial cost, making it an attractive choice for cautious traders.

Think of it like placing a controlled bet in a range you feel confident about, rather than putting all your chips on one unpredictable outcome.

Do you need to be right about every price movement? Not exactly. The beauty of the butterfly spread is its focus on predicting where the price won’t go rather than exactly where it will land. That’s why it’s often used in stable markets.

Long vs. Short Butterfly Spreads: Understanding the Differences

Butterfly spreads can be split into two main types: long and short. These approaches hinge on whether you expect the market to remain stable or experience significant fluctuations.

A long butterfly spread is the more common of the two. In this strategy, you buy options with a low and high strike price and sell two at the middle strike price. This structure thrives in range-bound markets where prices don’t swing wildly, allowing you to benefit from minimal movement.

In contrast, a short butterfly spread bets on increased volatility. Here, you flip the structure by selling the wings and buying the body. In volatile markets, prices tend to deviate from the middle strike price, and a short butterfly spread aims to profit from these significant movements. The risks are higher, but so are the potential rewards.

For example, imagine you’re expecting a major earnings announcement that could move the stock significantly. A short butterfly spread lets you capitalize on that, even if you’re unsure which way the price will go.

When and Why Do Traders Use Butterfly Spreads?

Traders typically use butterfly spreads when they expect a stock or index to stay within a specific price range by the time the options expire. The strategy is often employed during times of low volatility or when traders have a neutral outlook on the market. However, that doesn’t mean the strategy is limited to calm market conditions—it’s adaptable depending on your approach.

Why do traders like this strategy? It limits both risk and reward. If you’re looking for big gains, this might not be your go-to option, but if you prefer controlled risk and a defined maximum loss, butterfly spreads could be your friend.

Traders also use butterfly spreads as a way to hedge against more volatile positions. For instance, if a trader has a bullish position but fears a significant price drop, they may use a butterfly spread to limit potential losses. Imagine having an umbrella handy—you don’t expect rain, but it’s better to be prepared in case a storm suddenly rolls in.

Can Butterfly Spreads Handle Volatile Markets?

While butterfly spreads are often used in more stable markets, they can be applied in volatile environments too, with some adjustments. In volatile markets, the main challenge is that large price movements can take the asset far from the middle strike price, reducing the strategy’s profitability. To counter this, traders may opt for wider strike prices to allow for larger price swings.

For example, in times of economic uncertainty, stocks might swing drastically. A traditional butterfly spread could struggle here, but a broken-wing butterfly or iron butterfly might be more suitable. These variations of the strategy allow traders to handle bigger price movements, offering more flexibility.

Are butterfly spreads foolproof in volatility? Of course not, but with the right adjustments, they can offer a safer way to play in unpredictable markets.

Think of it like driving with extra caution during a storm—you don’t stop driving, but you adjust your speed and route to ensure you’re not taking unnecessary risks.

Real-World Example: Using Butterfly Spreads in Practice

Let’s say a trader believes that a stock, currently trading at $100, will hover around this price until the options expiration date. They could set up a long butterfly spread by purchasing one option at $95, selling two at $100, and buying another at $105. If the stock stays near $100, the trader profits from the strategy with minimal risk.

On the flip side, if the market suddenly becomes volatile and swings the price far above or below $100, the trader’s profits shrink, and they might even incur a small loss, but it’s limited. The key to success here is understanding the market conditions and choosing the right spread for the situation.

Always remember to consult a financial advisor before diving into more complex strategies like butterfly spreads. While they limit risk, they also require a solid understanding of the market and timing to be effective.

Conclusion

For traders looking to hedge against big price swings, the Butterfly Spread offers precision and control. It’s a strategy where balance, not bold moves, defines success.