Investing can stir up emotions like fear and anxiety, but mastering your mindset is key to staying on course. Learn psychological techniques to manage these emotions and build confidence in…

Author: Steven

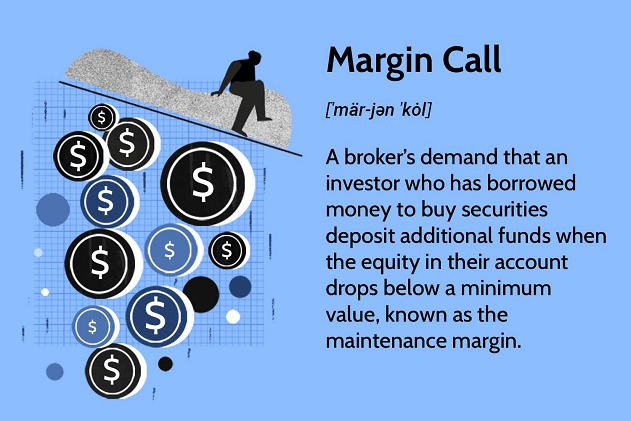

Automatic Closures: Stop-Loss And Margin Call Scenarios

Navigating the fast-paced world of trading demands protective measures like stop-loss and margin calls. These automatic closures aren’t just safeguards—they’re vital strategies to preserve your capital when the market turns…

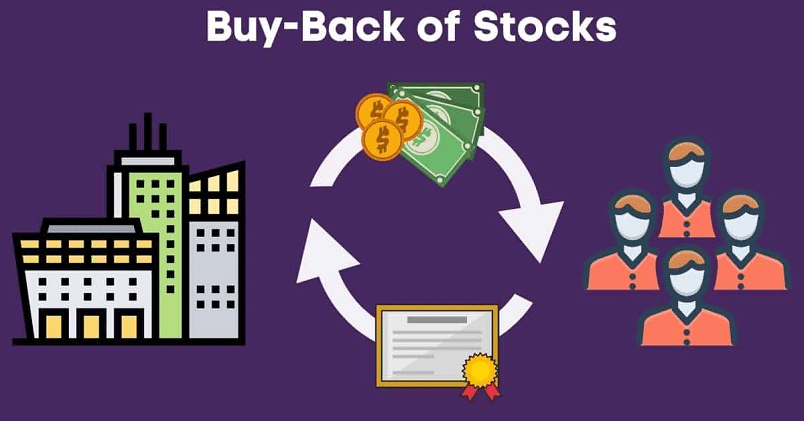

Signaling To The Market: How Buybacks Can Reflect Corporate Confidence Or Desperation?

Corporate buybacks can send powerful signals to the market. They might reveal a company’s confidence in its future or hint at underlying financial struggles. Understanding the real message behind these…

Recognizing Market Signals And External Triggers For Rebalancing

Recognizing market signals and external triggers for rebalancing can be the difference between safeguarding your portfolio and missing critical opportunities. With shifting trends and unpredictable forces, knowing when to act…

The Double-Edged Sword: Risks And Rewards In Volatile Markets

Volatile markets can feel like a thrilling roller coaster, offering both high rewards and steep risks. For savvy investors, navigating these fluctuations can lead to immense profits. However, without a…

Decoding The Mechanism: What Are Share Buybacks And How Do They Work?

Share buybacks let companies reduce the number of shares available, boosting their market value. But understanding how they work helps investors grasp the strategic power behind the move. Could a…

Currencies And Forex: The Largest Segment Of Otc Markets

The foreign exchange (forex) market is the heartbeat of the OTC world, where trillions of dollars are traded daily. Its size and liquidity make it an unmatched force in global…

Decoding The Financial Statements: What Investors Should Look For

Financial statements are the backbone of investment decisions. Decoding balance sheets, income statements, and cash flow helps investors uncover the true financial health of a company. Have you ever wondered…

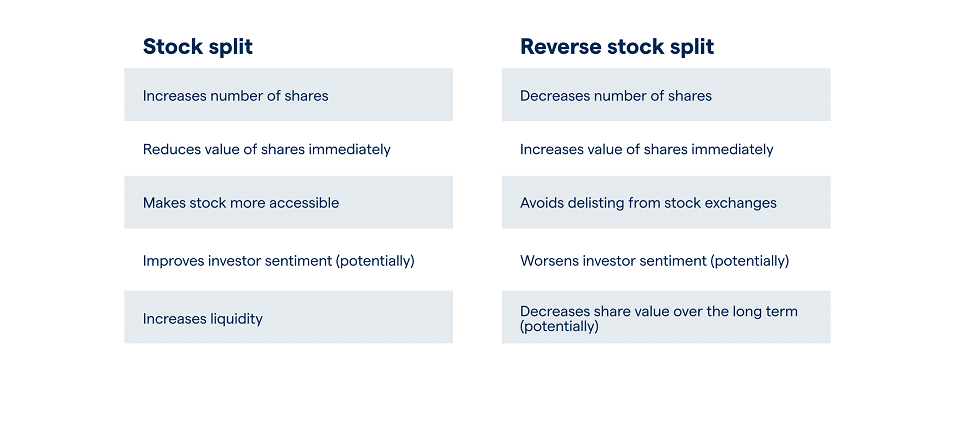

Mechanics Of A Stock Split Vs. A Reverse Stock Split: How They Work?

Stock splits and reverse stock splits are powerful financial maneuvers that can reshape a company’s stock value without altering its market cap. Understanding how these splits work helps investors anticipate…

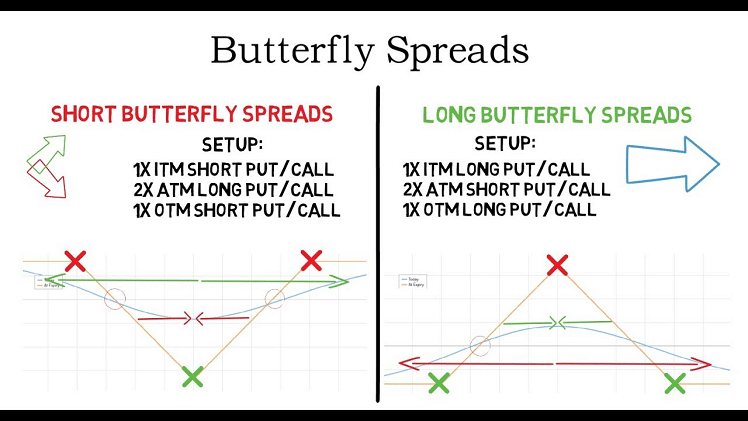

Defining The Butterfly Spread: A Strategic Overview

The Butterfly Spread is a sophisticated options strategy that allows traders to profit from minimal price movement. Understanding its setup provides a valuable tool for risk management. What if you…